SMSF Association Throughout the Years

We have dedicated over 20 Years to our vision of enabling Australians to take greater control of their own financial well-being through a sustainable SMSF community

Our mission to lead the professionalism, integrity and sustainability of the SMSF sector continues to drive everything we do.

Our Story

SMSF Professionals' Association of Australia was established

The SMSF Professionals' Association of Australia (SPAA) was established 7 January 2003 and officially launched in Sydney on 28 April 2003.

The inaugural CEO was Andrea Slattery, with Peter Fry as the inaugural Chairman of the board.

Sir Anthony Mason was the Association's Patron.

7 January 2003SPAA held its first National Conference

150 Attendees joined the SMSF Professionals' Association of Australia (SPAA) for their inaugural National Conference.

2003First state chapters established

For the first time, state chapters were established in Victoria, South Australia, New South Wales and Western Australia.

2004SMSF Specialist Advisor (SSA) Accreditation Program Launched

SMSF Specialist Auditor (SSAud) Accreditation Program Launched

Following the success of our SSA designation, our SMSF Specialist Auditor (SSAud) accreditation program was launched and first exams held.

2008National Conference exceeds 1,000 Attendees

Contributing to the Cooper Review

SPAA contributed to the Cooper review, lodging 3 comprehensive submissions in 8 months advocating for, among other things, the in-house asset and business real property exemptions and investment flexibility of SMSFs to be retained

2010The SMSF Specialist Auditor (SSAud) embedded in the law

Categorisation of SMSF investors

Advocated against the $500k lifetime limit

Our advocacy efforts against the proposed introduction of a $500k lifetime limit on non-concessional contributions resulted in the Government agreeing to abandon the proposal in favour on an annual cap.

2016National Conference exceeds 1,700 attendees

New Patron appointed

Recommendation for Concessional TBAR reporting adopted

Concessional TBAR reporting regime announced for SMSFs with the ATO adopting the SMSF Association's recommendation to relax the rules for SMSFs with balances under $1 million.

20183 Year Audit Proposal Overturned

The 3 year audit proposal was released by the Government, and later overturned following analysis from the SMSF Association and others which showed the intended policy outcomes would not be achieved.

2018Formed Alliance to successfully advocate against the ALP’s franking credit proposal

Challenged balance of at least $1 million to be considered cost effective

The SMSF Association challenged the Productivity Commission’s draft finding that SMSFs need a balance of at least $1 million to be considered cost effective. The Productivity Commission subsequently reduced the threshold to $500,000 and recommended that SMSF advice is underpinned by specialist education requirements, reflecting a long held policy position of the Association.

2019Fellow Membership introduced

Research released showing SMSFs cost effective at $200K or more

2 year amnesty for legacy pensions and reforms to the residency rules announced in the Federal Budget

Our pre-budget submissions called for a 2 year amnesty for legacy pensions conversion, the removal of the active member test and modification of the central management & control test. These initiatives were subsequently taken by Government and announced in the 2021 Federal Budget.

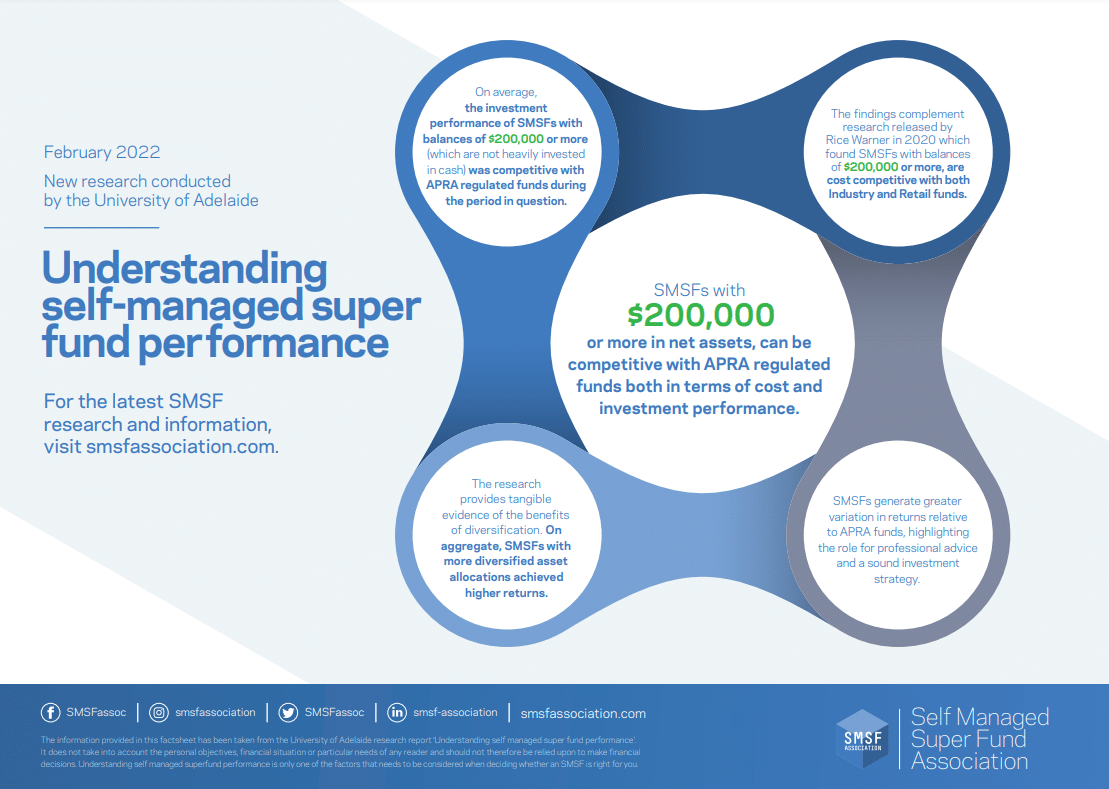

2021Research released showing SMSFs achieve critical mass at $200K

This showed SMSFs achieve critical mass at balances of $200,000. The research was based on data from over 50% of the entire SMSF population – the largest and most comprehensive research study ever undertaken on SMSF performance.

The Association subsequently wrote to ASIC requesting a review of their SMSF Advice guidance.

In late 2022, ASIC released updated SMSF Advice guidance. The ATO subsequently updated disclosures on using ATO SMSF performance data to compare the performance of the SMSF sector with the APRA fund sector.

2022Joint Association Working Group formed

Partnered with both Kaplan Professional and Deakin University

The SMSF Regulations and Taxation unit, developed by the Association, was made available as an elective unit in the Kaplan Professional and Deakin University Master of Financial Planning degrees.

2022SMSF Association celebrates legacy pension amnesty win for retirees

The SMSF Association lauded the Federal Government’s decision to fast track the implementation of a legacy pension amnesty.

SMSF Association CEO Peter Burgess said this is an early Christmas gift for over 17,000 SMSF legacy pension accounts that now have five years to commute their pension and take advantage of a flexible pathway to allocate associated reserve amounts.

2024The SMSF sector surpassed $1 trillion in net assets

The self managed super fund (SMSF) sector notched up a significant milestone following the release of the Australian Taxation Office’s (ATO) September 2024 quarter SMSF statistics which showed the total SMSFs assets surpassed $1 trillion for the first time.

2024